2020 = Clear Vision

Clear Vision

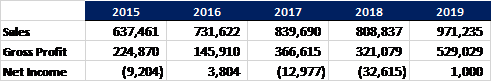

The benefit of hindsight is that it paint’s a picture of the past and provides an indication towards the future. Consider the following business data illustrating it’s history of performance:

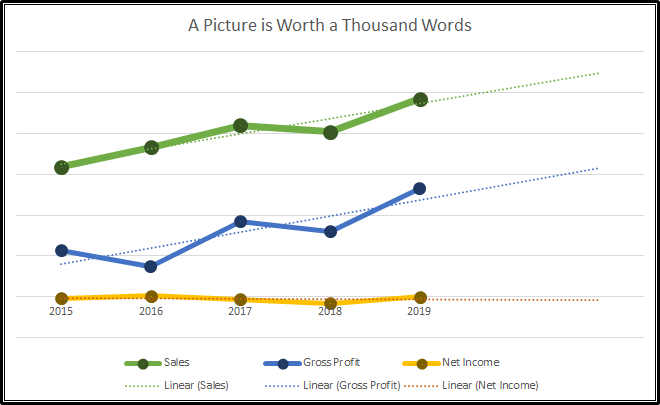

Now let’s take these data points and paint a picture with them:

-

Sales are growing. At least one of the following is happening:

- The customers are continuing to trade with the company

-

New customers are being added faster than customers are lost

-

It’s products or services are readily accepted by the marketplace

-

The companies advertising effectiveness is positive, returning a greater return than cost

-

It’s market share is growing

-

Gross Profit is staying even with Sales, even though it does fluctuate over time. This could mean:

-

Product mix is changing as customers are growing / added

-

Pricing is being adjusted in conjunction with or shortly after a change in cost is experienced

-

-

Net Income is declining as revenues increase. This could mean:

-

Business is adding expenses / overhead faster than the Sales can cover them

-

The working capital requirements are growing faster than profits

-

The owner has little to no controls in place to manage the business as it grows

-

The picture shows us a clear vision that the Net Income line is crying out for help. Profits are sporadic and not growing with sales and gross margin, an unhealthy condition. Without some sustained corrective action to profits, this business may be in trouble.

This picture starts raising the hair on the back of my neck. To investigate further, I turn to the balance sheet. There I see a more pronounced cry for help. Book value is falling like a rock as the cash position weakens while the debt climbs. This situation is worse than expected and I now see clearly that though the owner projects a calm, confident exterior, he is really desperate for help. His cash position is weak and he struggles to borrow from Peter to pay Paul. More than a cry for help, this is a 911 emergency!

Keep in mind that all of this is taking place in an economy which has delivered the strongest growth of a generation. In fact, the USA is now experiencing the longest uninterrupted expansion cycle in our history.

THE BOTTOM LINE

Start by making sure your business financial information is complete, up-to-date and accurate. Have a full range of business financial reports at your disposal: Profit & Loss, Balance Sheets, Cash-flow Statements. Use the data to paint a picture of what has happened and then project that performance into the future.

Finally, ask for help where warranted. The best performer’s are continually engaging coaches who can help them improve to achieve more than they could on their own. Have a clear vision about your business and it’s future and take the necessary actions to make 2020 your best year yet.