Terry Lammers, CVA

Terry is a Managing Member of Innovative Business Advisors. Terry received his designation as a Certified Valuation Analyst (CVA). This is an accreditation through the National Association of Certified Valuation Analysts (NACVA). Terry also holds a Real Estate Brokers License with the state of Illinois.

He is the author of You Don't Know What You Don't Know™. To learn more about Terry, click here.

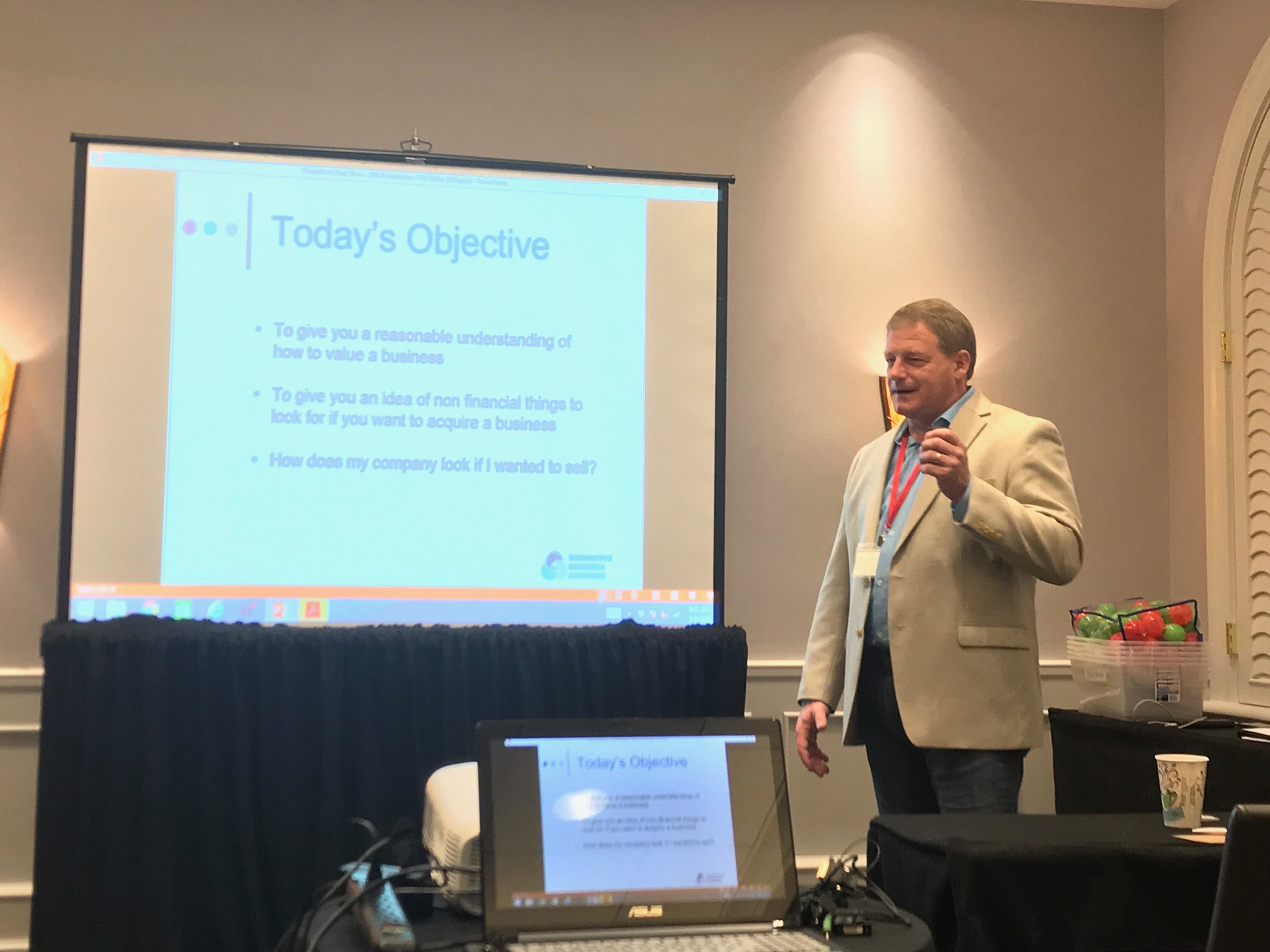

SPEAKING ENGAGEMENTS

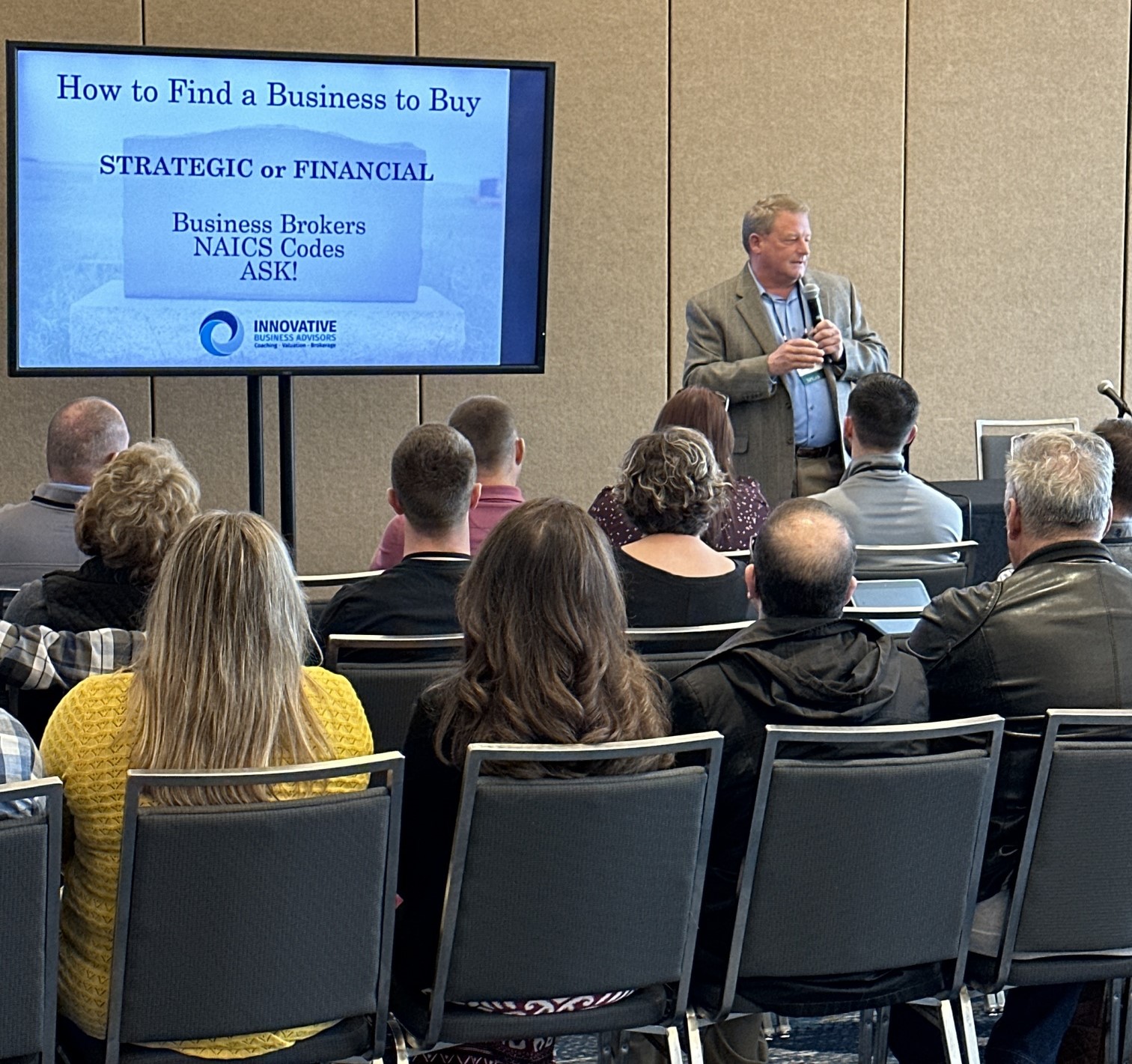

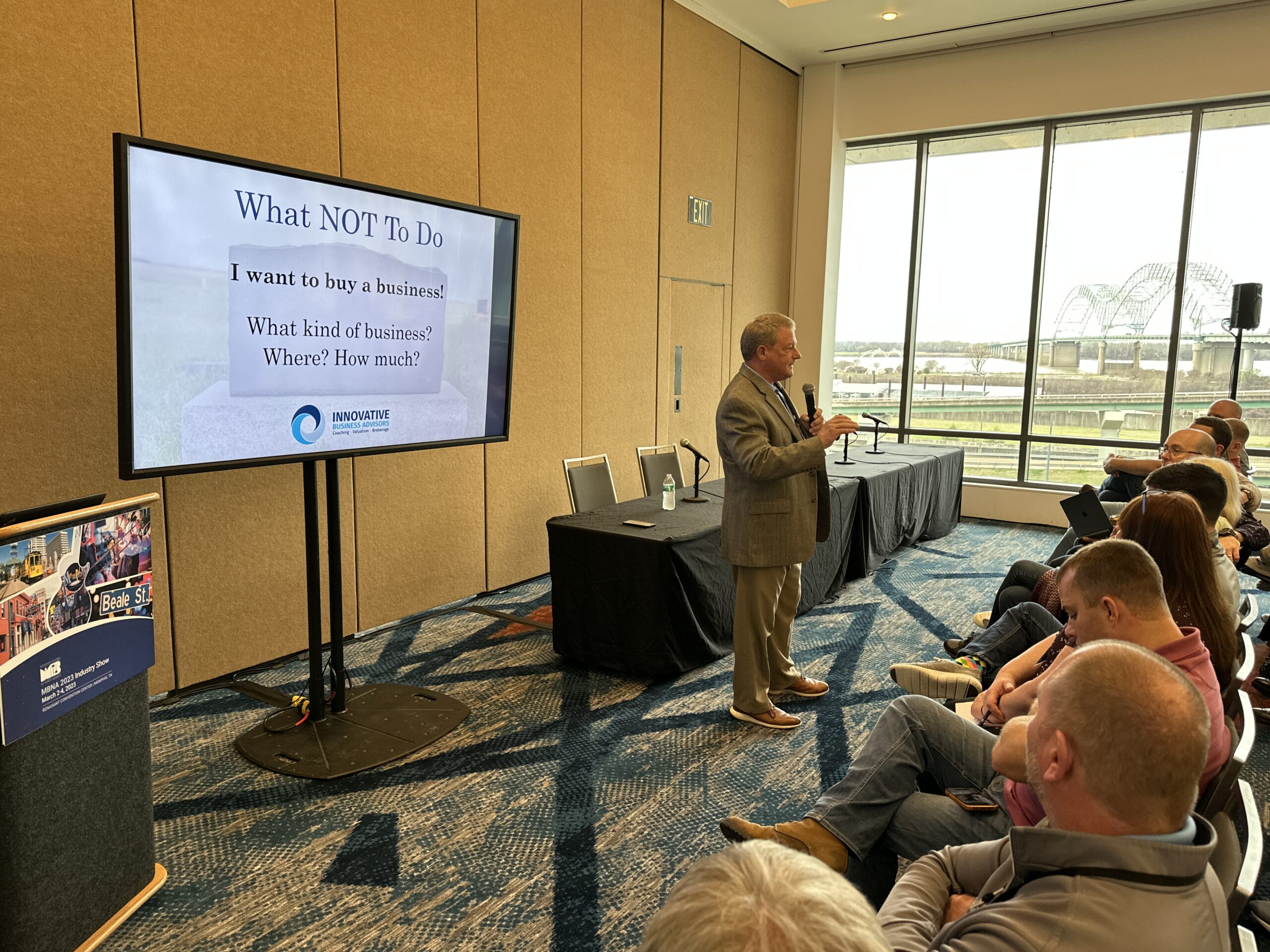

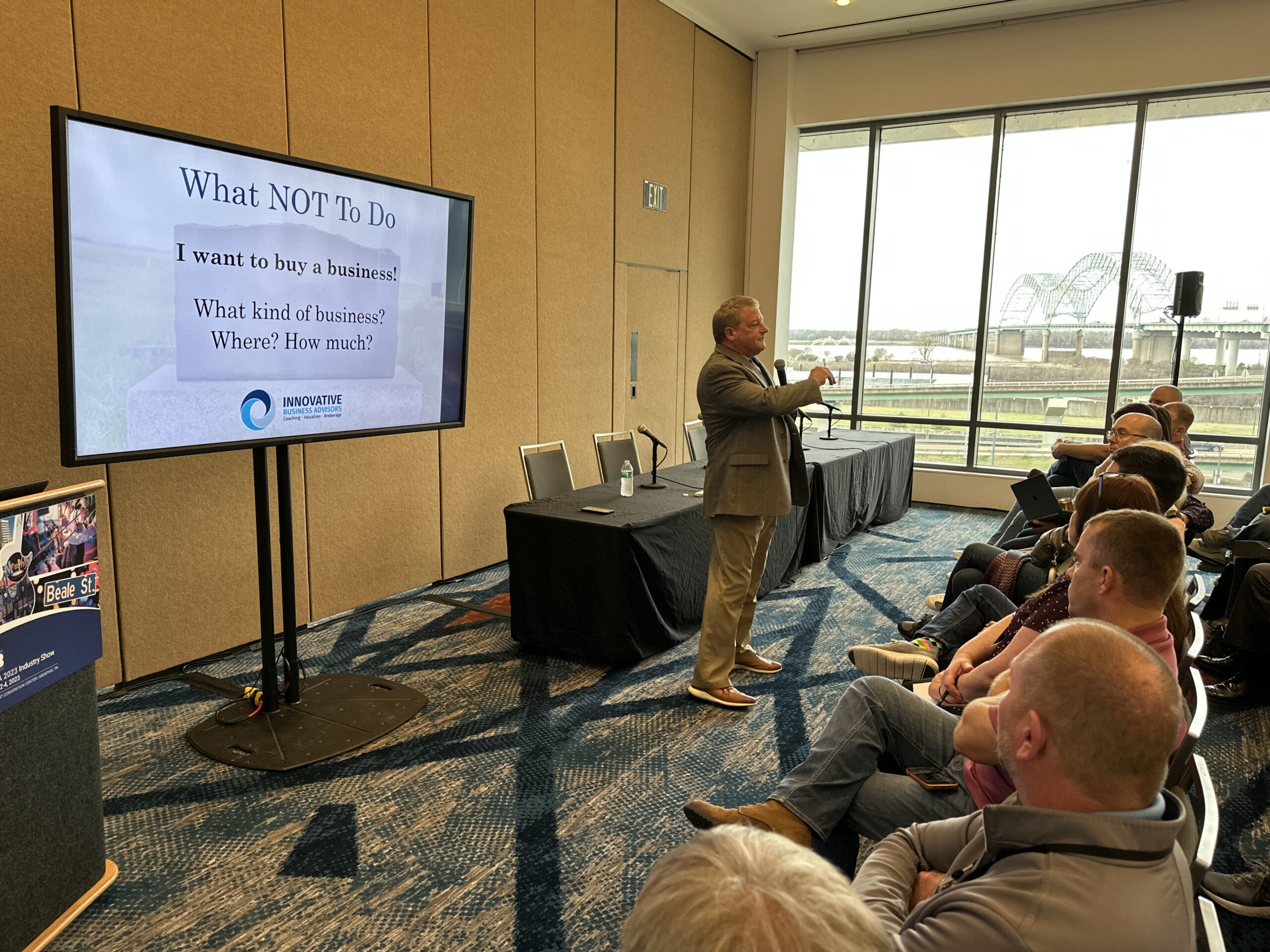

Terry Lammers was honored to give a presentation at the Monument Builders of North America Conference in March 2023 in Memphis, TN at the MBNA 2023 Industry Show.

Monument Builders of North America (MBNA) is the voice of memorialists in North America and works to increase the public’s appreciation of permanent memorialization of loved ones. The association also strives to improve the art of memorialization by providing educational and training programs to all segments of the industry.

Terry's presentation covered the 8 Steps to Building Value in Your Business. Here is a link to his interview with MBNA after the presentation:

If you are interested in having Terry speak at your next event, you can contact him at terry@innovativeba.com or 618-530-8922.

The following is a link to Terry's presentation during SBA Week at Medici MediaSpace where he spoke about why it's important to get a business valuation, as well as the different methods of evaluating the cash flow in your business to determine the business value (5/10/19):

This is an interactive presentation and the attendees left with an understanding of how to value a business and an overview of the NON-FINANCIAL things that influence value.

Terry was honored to speak at the Independent Truck Repair Group's (ITRG) Tradeshow & Training Conferences in Dallas and Denver on 3/9/19 and 6/21/19. Here is a link to the video of his presentation at ITRG's Tradeshow and Training Conference in March:

https://www.youtube.com/watch?v=QWiFzrloCLM&t=88s

If you are interested in having Terry speak at your next event, you can contact him at terry@innovativeba.com or 618-530-8922.

PODCAST EPISODES

ARTICLES

How to Make the Most of Your Business Valuation (Even if You’re Not Ready to Sell)

What is your company worth? If you've considered what life after running your current business might be like, you've probably given this some thought. But here's the real question you should be asking: Is your own estimate accurate?

It probably isn't. While no one knows your business better than you do, that doesn't mean you understand the intricacies of determining what someone else would pay for it. That's why it's essential to seek out a professional to help you come to an accurate valuation. And once you do that, there are a few steps you can take to make the most of that valuation — whether you're ready to sell or not. Read the full article here. Published on 3/19/19 on Due.com.

3 Steps to Prepare Your Business for Sale in 2019

It might not be something they like to talk about, but all business owners should at least think about what their exit strategy is. Even massive companies like Campbell Soup Co. sell off business units at one point or another, so it’s best to be prepared.

Plus, there’s never been a better time to sell. Citizens Bank’s 2019 mergers and acquisitions survey of 600 companies found that 62 percentof potential sellers are either already engaged in a transaction or looking to sell a business this year.

As the Baby Boomer generation inches closer to retirement, valuations are steadily increasing. The economy is in good shape, and banks are still hungry for loans and, therefore, offering attractive deals. Read the full article here. Published on 3/20/19 on Equities.com.

3 Signs It's Time to Move on From Your Startup (and How to Get That Move Started)

Selling a business is hard. Emotions run the gamut from happy to sad to proud to disgusted. Many founders look at their startups as their babies — the time and energy that running a successful company requires make it a lot like raising a child. And when you're not able to see that commitment pay off the way you expect, it can be tough to walk away.

In a perfect world, you'd have your exit strategy planned 10 years in advance of a sale. But let's face it: Most founders don't, and most don't know when to start creating one. Read the full article here to learn about three of the most obvious signs that it's time for you to create an exit plan. Published on 3/25/19 on Entrepreneur.com.

Find Financials Confusing? Here’s How To Make Them Work For You

Leaders today must know the financials of their companies for the same reason doctors monitor patients’ vitals. How can you solve a problem if you’re unaware of it? Knowing a few key performance indicators about the company’s finances can be crucial for improving its health.

Best of all, CEOs don’t have to track tons of figures. They just need to keep an eye on a few things every month, such as the income statement, balance sheet, and cash flow statement. If something seems amiss, they can find the right person to fix it.

This is less arduous than it sounds. The first step is to identify the most common errors found in businesses’ financial processes and remedy them with permanent proven solutions.

Published on 5/9/19 on CEOWorld.biz.

Why Every Startup Needs to Shift Its Focus From the Checkbook to Cash Flow

Starting a business comes with a hefty price tag. You have to purchase equipment, hire staff, and lease an office space. When you're fighting for survival, you aren't carefully reviewing financial statements — you only know what's in your checkbook. Your vision for the company started long-term, but in the trenches, all you can consider is how to make it through the day, the week, or the month.

Hopefully, you can get your head above water and have some predictability month after month. You can take time to prioritize finances and see how healthy the business is. Now is the time to switch your focus from the checkbook to key performance indicators that will help you manage cash flow.

Read the full article here to learn more. Published on 6/7/19 on blog.eonetwork.org.

Avoid a Disastrous Acquisition by Following These 5 Steps

Most executives would agree that it's important to scour the books for any signs of concern before an acquisition. The problem is that it can be hard to see red flags through rose-colored glasses, so many buyers miss big issues.

So, how do you know what to look for to prevent these issues? Read the full article here to learn about 5 areas you should look into when examining the financial statements of your prospective acquisition.

Published on 7/1/19 on https://born2invest.com.

Use Accrual Accounting for Long-Term Success

As a small business owner, you've probably identified the perfect niche market, you're passionate about your company's services, and you're focused on growing your business and polishing your brand. But you might be overlooking an equally important accounting decision you need to make: Do you use cash basis accounting or accrual accounting?

After years of working with small businesses, I'm convinced that accrual accounting is the best option for your company. Read the full article here to learn why.

Published on 7/22/19 on Due.com.

3 Non-financial Factors That Affect the Value of Your Business

A lot more than your business’s financial statements determine its true worth.

- The top three non-financial factors that can drastically affect business values are management structures, diversity, and growth potential.

- If you’re the buyer, these factors can help you see the bigger picture outside the numbers and get an idea of what’s actually driving the business’s success.

- If you’re the owner, these factors can give you a sense for which value drivers are important and what levers you can be pulling to maximize the value of your business for potential buyers.

Read the full article here.

Published on 9/18/19 on Business.com.

How a Laissez-Faire Approach to Management Increases the Value of Your Business

In many businesses, management functions as the hub of the company's "wheel." Without the hub holding together the spokes - the employees, customers, and suppliers - the wheel can't turn.

As a business owner, it can be easy to think that by micromanaging, you're setting your company up for a successful sale someday. But you actually might be enabling operational problems without realizing it.

Read the full article here to learn about some tips you can use to loosen the reins.

Originally published on 10/5/19 on CEOWorld.biz.

Your Business is Profitable - But Could You Still Go Broke?

You might be excellent at running your business - but do you know how to manage your company's finances? Even if your business is profitable, your cash flow may still suffer if you ignore your numbers. Start with these three steps to develop your business background.

Read the full article here.

Originally published on 10/18/19 on American Express.com.

PRESS MENTIONS

How to Become an Entrepreneur Without Starting From Scratch

If this avenue into entrepreneurship interests you, there may be plenty of opportunities in the years to come. As Terry Lammers, managing member of Innovative Business Advisors, observes, “We are currently in an era where there is going to be a massive amount of businesses being sold because of the retiring baby boomers.” Not only does this approach land you an established product and market, but an acquired company also brings with it skilled, experienced employees. That’s no small consideration in today’s tight labor market.

Entrepreneurship is most certainly not for everyone. At the same time, there are many different ways to become an entrepreneur, and one could be the right path for you. Before venturing out on your own, take the time to explore what’s possible, and create a plan to get where you want to be. No matter which path you choose, hustle, grit, and determination won't be optional. Read the full article here. This article was written by Serenity Gibbons and was published on 4/2/19 on Forbes.com.

6 Financial Reports to Help Monitor Your Business

A wide variety of financial reports exist. While they're all important, it's a good idea to keep a close eye on several specific numbers.

"You can have a good idea of how your company is performing by focusing on just a few key performance indicators [KPIs]," says Terry Lammers, managing member of Innovative Business Advisors, which performs business valuation and helps people buy and sell companies.

"Though, you won't be able to run your company by focusing solely on just a few KPIs without ever looking at others, there are some to keep an eye on more frequently." Read the full article here.

This article was written by Julie Bawden Davis and was published on 4/30/19 on AmericanExpress.com.

The Best Books to Help Entrepreneurs Grow a Business

Since the inaugural season of Shark Tank, every entrepreneur (or entrepreneur-to-be) has been talking about the idea of business scalability. Even middle schoolers bandy the term with startling ease. Yet despite the lexical ubiquity of "scaling," company growth remains a conundrum, even to serial entrepreneurs and talented first-time founders.

If you've looked high and low for recommendations on boosting your incoming lead sources, creating and leveraging brand traction and slaughtering your quarterly revenue projections, you need to read these seven books. They'll not only improve you as a corporate leader, buy they'll help you refine and define your professional style as you expand your dream.

Read the full article here. You Don't Know What You Don't Know™ by Terry Lammers, CVA is the first on the list of top 7 books on growing your business. This article was written by Rhett Power and was published on 10/25/19 on Forbes.com.

5/22/19 -

5/22/19 -